What’s more, except for the discussed ratios, stock traders are using 50% levels, which is effective, as well.ĭespite their success, Fibonacci retracements have certain philosophical and technological drawbacks that traders should be mindful of until employing them.įor example, any Fibonacci tool's fundamental theory is a computational paradox that is not supported by any logical proof. Take note of how the market shifts course as it reaches the support and resistance thresholds.

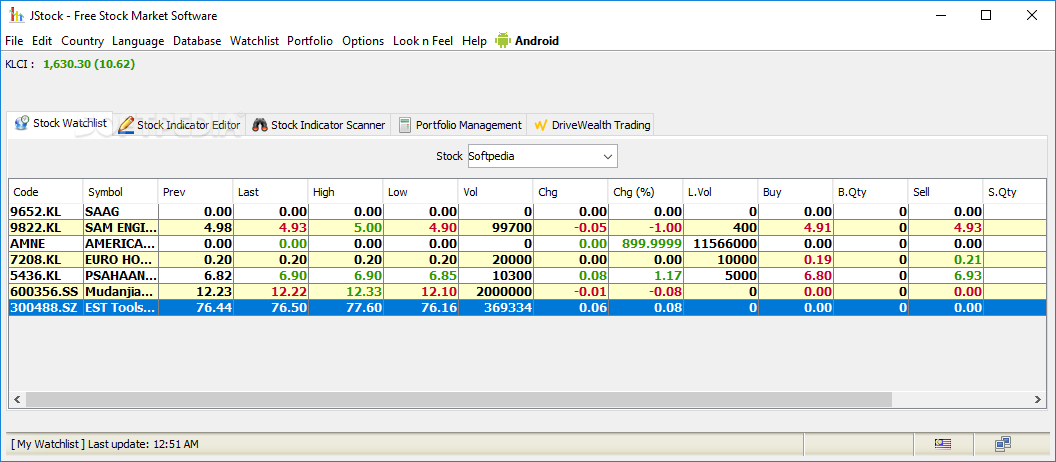

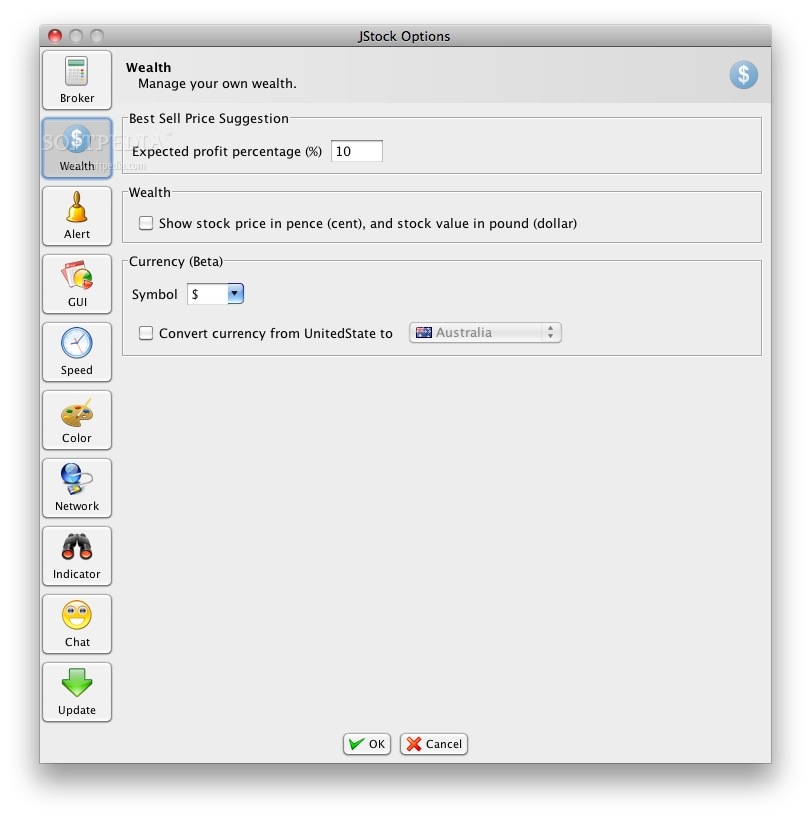

Jstock fibbonacci software#

Most popular trading platforms have software that automatically draws horizontal lines. However, the price of the stock normally retraces to one of the above-mentioned ratios before that happens. The previous pattern is likely to persist. It indicates how much of a previous shift the market has retraced. Fibonacci ratios may also be used as the core principle in a countertrend trading technique.Įach level is correlated with one of the above ratios or percentages. They can be used to outline support or opposition lines, as well as to position stop-loss orders and set goal prices. This is due in part to their simple versatility and in part to their usefulness to virtually every trading instrument. These Fibonacci indicators are the most commonly used Fibonacci trading method. Technical traders attempt to use them to identify key points where the market movement of a commodity is expected to reverse. These Fibonacci ratios appear to play some role in the stock market, as they do in nature, for uncertain reasons. In order to determine A Fibonacci retracement, you need to divide the vertical gap between two radical points on a stock chart by the main Fibonacci ratios of 23.6 percent, 38.2 percent, 50 percent, 61.8 percent, and 100 percent.įibonacci retracement indicators in stocks have the same limitations as other universal trading instruments, however, they are usually used with the combination of other technical indicators, which makes this indicator more efficient and successful for stock trading. Fibonacci retracements are widely used by traders to draw lineouts, classify tension thresholds, position stop-loss signals, and set price targets. We will discuss them in detail below.įollowing the identification of Fibonacci ratios, horizontal lines are drawn and used to define potential assistance and resistance levels. The indicator is usually divided into two important segments, the Fibonacci retracement indicator, and the Fibonacci Ratio indicator. These thresholds may be used by traders to spot themselves for a deal. These ratios, such as 61.8 percent, 38.2 percent, and 23.6 percent, will assist a seller in determining the potential degree of retracement. When this ratio is multiplied by the stock price, it will provide useful information on target ranges, stop losses, and points of entry for stock trading.įibonacci indicators in stock trading usually show the ratios. For example, if you purchase a share at $100 and multiply this by the ratio, you get a level of $61.8, which may be a good stop loss. These numbers are then used in Fibonacci retracements and ratios.Īutochartist - Trading Fibonacci Patterns: Axiory Autochartist Training VideosĪs already mentioned, Fibonacci Indicators are widely used in the stock market. The sequence then adds 50% as a midpoint, as well as an inverse of these percentages at the end.

In fact, there is a separate percentage sequence as well: Traders use the Fibonacci in the stock market to determine percentage growths, trend confirmations etc.

This ratio, in particular, has been linked to stock market activity, and it regularly enforces retracements and goal levels. In nature, the golden ratio shows perfection. Moreover, when we divide every number in the sequence by the previous number, the ratio is always about 1.618 which is called the golden ratio. The sequence looks like this:Įvery following number is a sum of itself and the number before it. It is simply a sequence of numbers calculated by a 13th-century Italian Mathematician called Leonardo Fibonacci. So, let’s just explain how the Fibonacci Sequence works. Fibonacci Sequence in stock market trading is one of the technical indicators for predicting future movements in the stock market.

0 kommentar(er)

0 kommentar(er)